Instructions for looking up import taxes into the US and EU

This article shares how to look up import taxes into the US and EU for Vietnamese businesses to refer to when exporting to these markets.

1. Look up the EU import tariff schedule

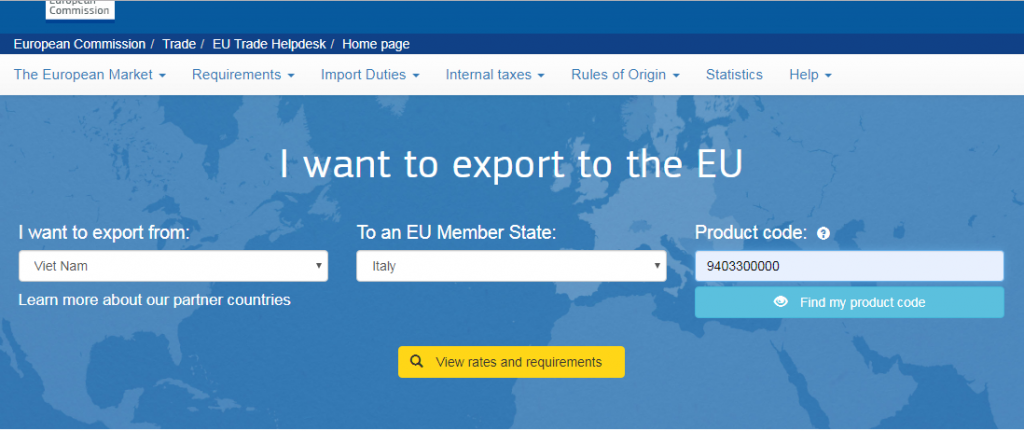

When you want to check the tax rate of Vietnamese goods or other countries exporting to the EU:

Click on the link below to look up tax on imported goods into the EU: https://trade.ec.europa.eu/tradehelp/

Enterprises fill in the necessary information:

– I want to export from: Country of origin (Vietnam)

– To an EU Member State: Purchasing country (name of the EU country the business intends to export to)

– Product code: EU customs tax code (HS code includes 10 digits)

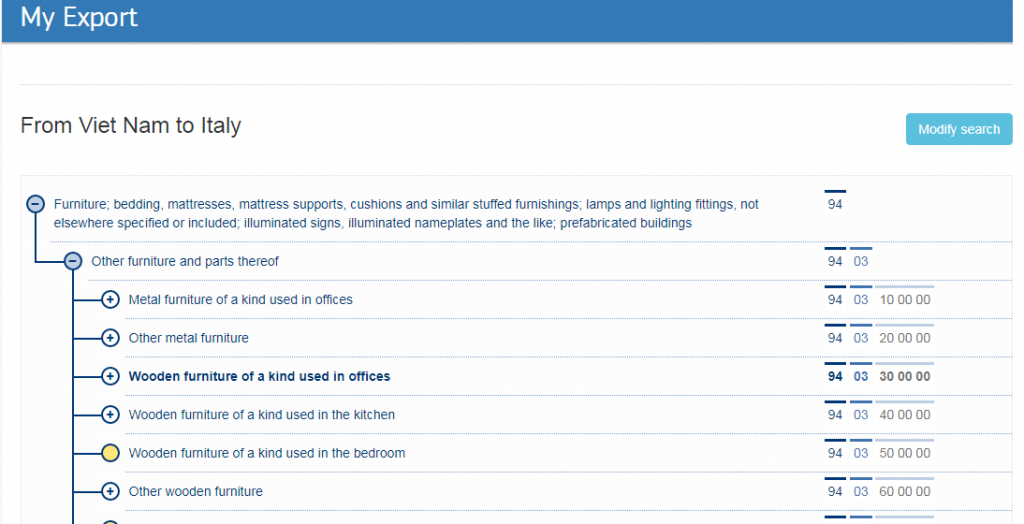

Button: Find my product code: If you do not know the HS code of the product that your business intends to export to an EU member country, click to check.

Finally, to look up EU import taxes, click on: View Rates and Requirements

The information received will include:

– Import Procedures.

– Product requirements.

– EU Import duties.

– Internal taxes.

– Rules of Origin GSP.

– Statistics.

– Show all.

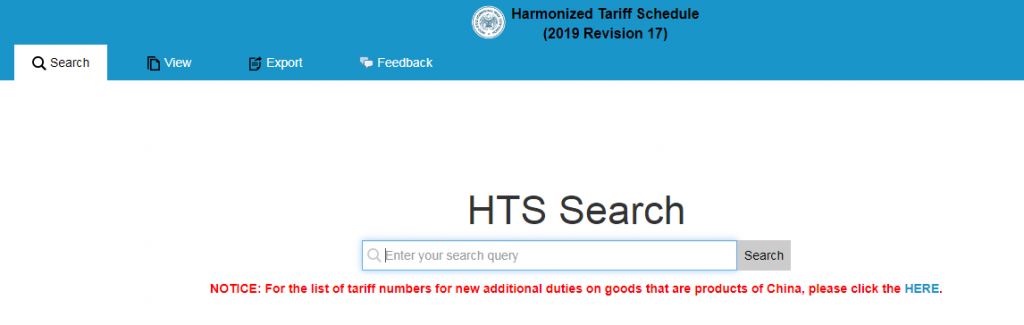

2. How to look up import tariffs into the US

Businesses who want to check the import tariff schedule into the US can access the link:

https://hts.usitc.gov/

https://hts.usitc.gov/current

Enterprises enter the product name information and HS code they want to check into the box and Search.